Indicators on Best Forex Broker Uk You Should Know

Wiki Article

Top Guidelines Of Best Forex Broker Uk

Table of ContentsHow Best Forex Broker Uk can Save You Time, Stress, and Money.Top Guidelines Of Best Forex Broker UkExamine This Report about Best Forex Broker UkBest Forex Broker Uk Fundamentals ExplainedFascination About Best Forex Broker UkWhat Does Best Forex Broker Uk Do?See This Report about Best Forex Broker Uk

The customers of forex traders are currency speculators or financiers for huge institutional customers. Interested investors have a number of selections amongst foreign exchange investors online. A lot of foreign exchange deals are between sets of the currencies of the 10 countries that comprise the G10. The nations and their money consist of the U.S.dollars. To shut the trade, the trader sells the pair, which is comparable to buying united state dollars with euros. If the exchange price is higher when the investor closes the profession, the trader makes an earnings. Otherwise, the investor takes a loss. Opening up a foreign exchange trading account nowadays is rather easy and also can be done online.

Depending on the country the trader is trading from, that take advantage of can be 30 to 400 times the quantity available in the trading account. High take advantage of makes foreign exchange trading extremely high-risk as well as most investors shed cash trying it.

Some Ideas on Best Forex Broker Uk You Need To Know

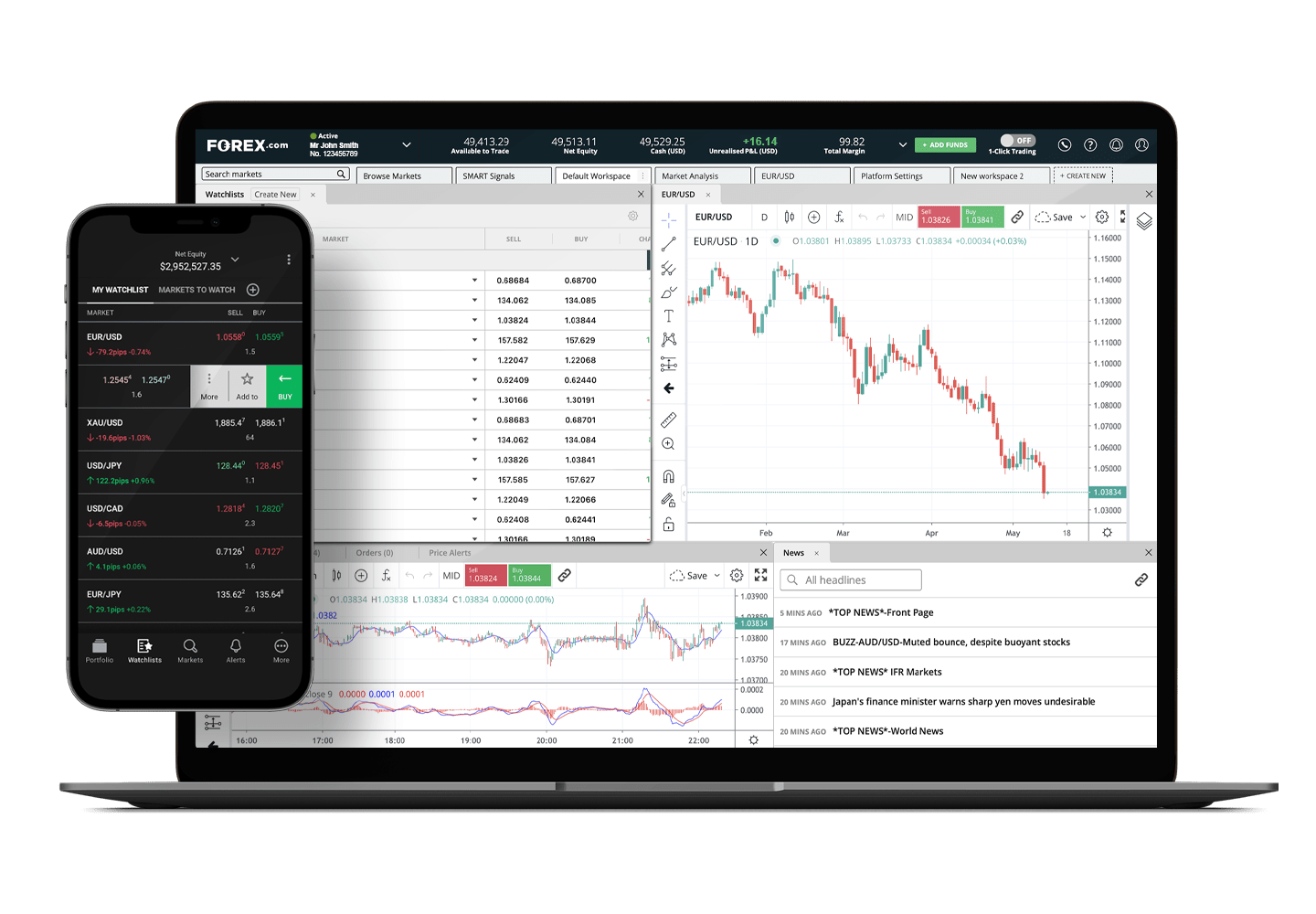

In order to select the appropriate broker to patronize, you require to recognize just how they work and also most notably, exactly how they can help you. Each broker is various as well as has its own qualities and failures. Some brokers may put a more powerful emphasis on customer support, or reduced fees, while others may use even more sophisticated tools and resources (Best Forex Broker UK).Certainly, there are also things that you ought to recognize when looking for your ideal broker, the sector has varying policies, and various nations impose more stringent legislations. In this overview, we're going to undergo just how Foreign exchange brokers can assist you on your course to success, how they generate income, as well as what to look out for when selecting the broker for you.

Foreign exchange Brokers can likewise be called a retail Forex broker, or a money trading broker. When you have a broker, you can access the marketplace to guess on increasing or falling rates in the hopes of making your own huge Soros win Okay, so you may not have that much money to take down (yet), but a big win none-the-less! Establishments or big firms can likewise benefit from broker solutions.

The Greatest Guide To Best Forex Broker Uk

You can after that begin dealing money sets. For instance, purchasing the British Extra pound with the U.S Buck will call for the purchase of the GBP/USD pair. Once you do this you can then attempt to earn a profit by shutting the set when the currency exchange rate change in your favor.

A broker will supply you utilize with your account, which varies in quantity. This utilize can be anywhere from 10:1 to 100:1. As an example, if you have $500, your broker might supply leverage of 100:1 which indicates that you can make a preliminary trade of a money set up to $50,000.

Rumored Buzz on Best Forex Broker Uk

Investors can often forget the risks that come along with a leverage. The broker market typically made many of see this website their revenue from compensation & costs, yet we are currently approaching a new era with lots of brokers lowering and also getting rid of charges in a proposal to remain competitive.Some brokers, consisting of copyright, are understood for their absolutely no cost plan, while online brokers consisting of Charles Schwab are quick on their heels to capture up. The spread is one manner in which brokers will certainly build up money. This is the distinction between the proposal as well as ask price of a currency set, or to put it simply, the rate at which to deal.

Some brokers supply a variable spread or a fixed spread, then take the difference between the market spread as well as their own spread. A Broker would certainly provide a variable infect stay clear of the possibility of a loss, or market threat. To do this, the broker includes a charge in addition to the spread, which leaves space for market fluctuations on the spread.

Fascination About Best Forex Broker Uk

If a broker is providing a repaired spread after that you'll have a pre-arranged spread regardless of the money pair. The suggestion is that the brokers spread will certainly be higher than the marketplace spread, which will certainly allow them to make money from the distinction. Dealt with rate spreads are less complicated to collaborate with as well as much better for consistency when purchasing as well as offering money pairs.

For instance, if you trade 100 units, you'll require to increase this by. 01 to get the payment rate. With this, if you are patronizing margin, go to this website then you will probably be charged a rates of interest for this, too. The last cost to be familiar with is an over night holding costs.

You will not need to pay a fee on futures trades though, due to the fact that they currently have the cost developed into the spread. Payments and also fees are currently ending up being a distant memory. In 2019 a multitude of brokers introduced absolutely no fees, causing a market shift like never ever prior to; this was a drastic change for a market that was once developed on payments, and also is leading the way for a more available market (Best Forex Broker UK).

Best Forex Broker Uk - Truths

This plan was directly followed by TD Ameritrade and also E * Trade, and also was the start of an end to the broker price-war that grew when the U.S Securities Acts Modifications of 1975 removed taken care of trading payments. This caused some opportunistic brokers boosting their costs, while Charles Schwab kept theirs at a fairly great $70 per profession.This change was good for consumers, however investors that typically would have gained their money from commissions, were not so satisfied. The share costs of Schwab, TD Ameritrade as well as E * Profession all took a hit. A loss of payments for Schwab will also be a loss of regarding $400 million in annual profits.

Although brokers typically made a lot of their revenue through payments, they still gain a great deal through various other techniques too. One way in which brokers can proceed to absorb revenue is by investing or lending out the cash that clients aren't making use of. The broker would take the cash money that wasn't being invested in client accounts and place it into one of their financial subsidiaries.

Best Forex Broker Uk - The Facts

12% passion and. 5% for accounts with over $1 million. You can make a bigger compensation on various other accounts, particularly the brokers possess accounts. Forex is a landmine of an industry. It's inconsistent, unpredictable, unstable as well as high-risk. It is also just starting to become a lot more easily accessible to younger investors as well as is a fairly new market for numerous, like this too.Report this wiki page